Meaning of Axios

Axios – Word that resonates with the essence of dignity and value. In many contexts, an axiom is synonymous with a postulate, law, or principle. It is an acclamation of faith, an expression that elevates the spirit by declaring something as worthy.

Axios is more than a word; it is a formative element that encapsulates the idea of dignity, of intrinsic value. It is a cry of confidence, an affirmation of credibility.

Axios I am worthy! – a proclamation that echoes in the heart, infusing courage and conviction. It is a powerful reminder that we are valuable, that our essence is worthy of respect and honor.

Se precisar de mais alguma coisa, estou aqui para ajudar!

About Us

At Axios, we are revolutionizing the market with highly disruptive services, bringing intelligence and innovation to every process and investment. Our commitment is to serve the interests of our clients, enhancing their strategies and elevating efficiency to new heights.

Our technological innovation center is a true beacon of investments, equipped with an advanced data monitoring and control center. Here, we provide comprehensive support to our investors, enabling them to elevate their actions, plan with precision, conduct in-depth analyses, and make assertive decisions.

We firmly believe that by integrating innovation and technology into our services, we promote an environment of dynamism, efficiency, control, security, and traceability. These benefits not only boost investment and M&A operations but also strengthen the Brazilian economy as a whole.

Axios Asset = Data Driven

Technology Center Investments,

M&A and ESG data

driven

Mission

To be determined in connecting ecosystems, transforming the future through visionary investments and strategic mergers, guided by the innovative power of technology and information.

Vision

To be a reference in innovation and transformation, creating a smarter future where technology and data, with ESG pillars, improve the performance of investments, companies, and people’s lives.

Values

Passion

Commitment

Ethics

Equality

Caring for people

Promoting sustainable investment

practices

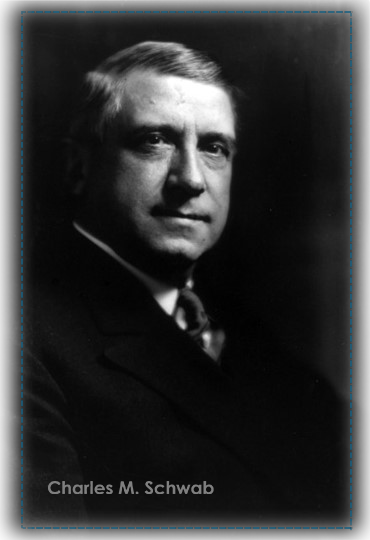

Charles M. Schwab

M&A Acquisitions and Consolidations

Jim Simons

Investments Multimarket

Andrew Carnegie sold his steel company, Carnegie Steel Company, to J.P. Morgan in 1901. This was one of the largest deals of the time, an acquisition worth $500 million, resulting in the creation of U.S. Steel Corporation.

As for the advisor who assisted Andrew Carnegie in the sale, his name was Charles M. Schwab. Schwab played a crucial role in the negotiation and was one of the key executives of Carnegie Steel. Charles M. Schwab presented a vertical consolidation strategy to J.P. Morgan and other investors interested in purchasing Carnegie Steel Company. He argued that by acquiring not only Carnegie Steel but also other competing companies and suppliers along the distribution chain, the new entity could better control costs, increase efficiency, and eliminate competition. This approach would allow the company to maximize its profits and significantly increase its value.

This vertical consolidation strategy was successfully implemented. The company increased its value several times over after the consolidation. Morgan not only provided the necessary financial resources but also used his influence to bring together various steel and iron companies under a single conglomerate, forming U.S. Steel Corporation. This merger resulted in the world’s first corporation to be worth over $1 billion. Morgan’s strategy was based on consolidation and efficiency, allowing U.S. Steel to dominate the market and significantly increase its value.

Inspiration

Jim Simons,

The Man Who Deciphered the Market

Mathematician and creator of Renaissance Technologies and the Medallion Fund.

Simons avoided standard managerial practices in favor of data analysis – finding patterns in data that predicted price changes. His technique was so successful that he became known as the “King of Quant.”

The mathematician who achieved average annual returns of 66% over the last 30 years.